Do you know that when trading on Exness, you need to pay a fee called the你知唔知喺 Exness 上面交易嗰陣,你需要畀一筆叫做嘅手續費 Exness commission xness 佣金The cost? Do you know how to calculate Exness commissions? Do you know how they affect your trading costs and profits? The article discusses..成本?你知唔知佢哋點樣影響你嘅交易成本同利潤? EX Trading EX 交易Get to know these fees together with you同你一齊認識呢啲費用

What is E? E 係咩?xness commission xness 佣金 ?

Exness commissions are the fees paid by clients to Exness when trading certain financial instruments. Commissions are calculated based on the volume of transactions (lots) and are charged twice: upon opening and closing a position. Commissions are one of Exness's main sources of revenue and are a significant factor in determining clients' trading costs.Exness 佣金係客戶喺交易某啲金融工具嗰陣向 Exness 支付嘅費用。佣金係根據交易量(批次)計算,並且收取兩次:開倉同收盤時佣金係 Exness 嘅主要收入來源之一,亦係決定客戶交易成本嘅重要因素。

Exness offers a range of excellent features. Diverse deposit and withdrawal methods, such asExness 提供一系列出色嘅功能,例如: Visa, Skrill, Neteller deposits at Exness...The Exness floor also offers..簽證,斯克里爾,網勒存款喺埃克斯內斯 ... 埃克斯內斯樓層亦提供 ..social trading Exness 社交交易 ExnessService that allows traders to connect with each other. In addition to the above points, Exness's commission fees are also a point of attraction for traders. Exness is considered the best commission platform in the world. Commission fees directly affect traders' income, which is why Exness attracts a large number of traders to participate in trading.令交易者互相聯繫嘅服務除咗以上幾點之外, Exness 嘅佣金費用亦都係交易者嘅一個吸引點,佣金費用直接影響交易者嘅收入,呢個就係 Exness 吸引大量交易者參與交易嘅原因。

Why Do Exness Commission Fees Differ?點解外勤佣金會唔同?

Exness commission 外勤佣金May vary depending on account type, trading tool, and trading time. According to Business Insider, at Exness, each trading order requires a commission payment from customers.可能會因帳戶類型、交易工具同交易時間而有所不同。據《商業內幕》報導,喺 Exness ,每個交易訂單都需要客戶支付佣金。At least $7 至少要 $ 7Specifically, Exness will具體嚟講, Exness 會At the time of your opening position喺你開倉嗰陣$3.50At the time of your liquidation, we will collect the remaining balance喺你清算嗰陣,我哋會收取剩餘嘅餘額$3.50

For example, if you buy 1 lot of EUR/USD, the commission per lot is $7. You will pay $3.5 when opening a position and another $3.5 when closing it. In total, you will incur a loss of $7 per lot of EUR/USD trade.例如你買1手歐元/美元,每手佣金係 $ 7。你開倉嗰陣會畀3.5美元,而喺收倉嗰陣再畀3.5美元。總括嚟講,你每手歐元/美元交易會損失7美元。

However, the commission fee may be higher or lower than $7 per lot depending on the trading instrument. Therefore, you should check the contract terms to understand the detailed commission fees applicable to each trading instrument.不過,佣金費用可能會高或者低過每手7美元,視乎交易工具而定,所以你應該睇吓合約條款,了解適用於每個交易工具嘅詳細佣金。

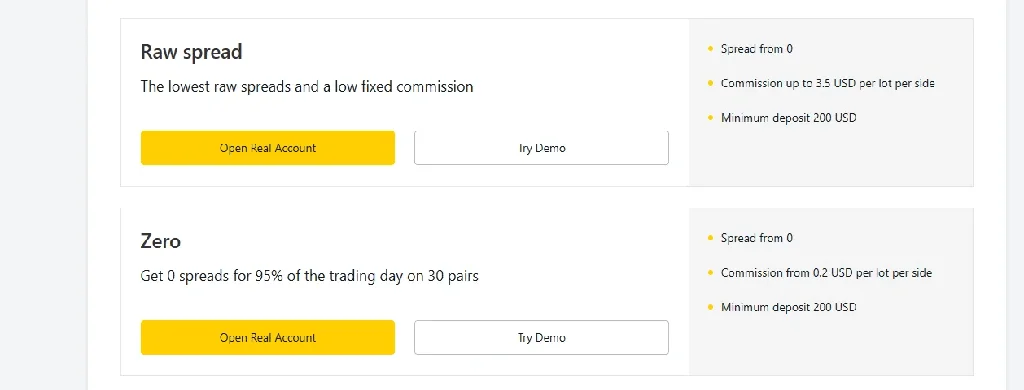

Applicable to E 適用於 Exness commission xness 佣金Account Types 帳戶類型

Not all account types offered by Exness charge commissions. According to Exness' Support Center, the available account types subject to trading commissions are:根據 Exness 嘅支援中心嘅資料,唔係所有 Exness 提供嘅帳戶類型都會收取佣金。零 和 Original Spread 原始傳播Commissions-Free Account Types Include免佣金帳戶類型包括Standard, 標準, Standard Cent 標準美分 和 Pro 專業人士。

Zero Account 零帳戶

The Zero Account is Exness' lowest spread account type, with just 0 pips. However, to compensate for the low spreads, trading commissions are applied.零戶口係 Exness 最低嘅差價戶口類型,只有0點數。不過,為咗補償低差價,交易佣金會被應用。Each hand starts at $0.20.每手由 $ 0.20起。It may vary depending on the transaction tool.佢可能會因交易工具而異。

For example, when opening a 1 lot trading order using the GBP/USD tool, the commission charged is:例如,當使用英鎊/美元工具開 1 手交易訂單時,收取嘅佣金係:9 USD, 9 美元,The commission for each trade of this tool on the account is 4.5 USD. No commission is charged for closing a trade, as the full 9 USD will be displayed when the trade is opened.呢個工具喺戶口上面每次交易嘅佣金係4.5美元。收盤唔收佣金,因為開盤時會顯示全部 9 美元。

Original Point Difference Account原始點差賬戶

The original point difference account is one with lower but non-zero point differences. The average point difference for major currency pairs is between 0.3 and 0.4 pips. However, to compensate for the lower point difference,原本嘅點差戶口係一個有較低但唔係零嘅點差。主要貨幣對嘅平均點差係0.3至0.4點之間。Most trading tools 大部分交易工具Each hand 每隻手Transaction commissions as high as $3.50 (varies for certain indices and cryptocurrencies).交易佣金高達 $ 3.50(因某啲指數同加密貨幣而異)。

For example, when opening a 1 lot trading position using the GBP/USD tool, the commission charged is:例如,當用英鎊/美元工具開 1 手交易頭寸時,收取嘅佣金係:$7Each trade incurs a commission of $3.50, with a one-way transaction in the original spread account. No commission is charged for closing a trade, as the full $7 will be displayed at the time of opening the trade.每次交易都會產生3.50美元嘅佣金,而單向交易喺原始差價戶口入面係唔會收取任何佣金,因為喺開交易嗰陣會顯示全額7美元。

Read More: 閱讀更多:Comprehensive Guide: The Latest and Most Accurate Guide for Traders to Open an Exness Account綜合指南:最新最準確嘅交易者開 Exness 戶口指南

How to Minimize Exness Commissions點樣將外費佣金減到最低

If you're not aware of how to minimize...如果你唔知點樣將 ... Exness commission xness 佣金,It could affect your profits. Here are some ways to save money when trading with Exness:呢個可能會影響你嘅利潤。以下係一啲喺同 Exness 交易嗰陣慳錢嘅方法:

- Choose an account type that suits your trading strategy. If you are a short-term trader or scalper, you should opt for zero or raw spread accounts to get the lowest spreads. If you are a medium to long-term trader or swing trader, you should choose standard, standard cent, or professional accounts to avoid paying commissions.揀一個適合你交易策略嘅戶口類型如果你係短期交易者或者炒家,你應該選擇零或者原始差價戶口,以獲得最低嘅差價。

- Join the Exness Rebate Program. Rebates are a portion of the commission fees returned to clients during their trading. This is a rebate program offered by Exness for its IB-recommended clients. Rebates help reduce costs and increase profits. The highest Exness rebate can reach加入 Exness 回贈計劃。回贈係指客戶喺交易期間退回嘅佣金嘅一部分。呢個係 Exness 為佢嘅 IB 推薦客戶提供嘅回贈計劃。回贈有助降低成本同增加利潤。 Exness 回贈最高可以達到 90% , depending on the account type and trading instrument.,視乎戶口類型同交易工具而定。

- Choose the appropriate trading time. Commission fees may fluctuate based on trading time due to factors such as price ranges, market liquidity, and economic news. Typically, commissions are higher during periods of significant price volatility, such as when important news is released or at market opening and closing times.選擇適當嘅交易時間,佣金費用可能會因為價格範圍、市場流動性同經濟新聞等因素而有所變動。通常,喺價格大幅波動嘅時期,例如重要消息發佈或者市場開市同收市時間,佣金會較高。

Cost-saving example when trading with Exness同 Exness 交易嗰陣節省成本嘅例子

If you trade 1 lot of EUR/USD on a zero account, the commission is $9. You will receive a refund of 90% x $9 = $8.10. Therefore, you only need to pay $0.90 per trade. To participate in Exness's rebate program, you need to register an account through a reputable IB, which offers a higher rebate rate.如果你用零戶口交易1批歐元/美元,佣金係 $ 9。你會收到90 % x $9 = $8.10嘅退款。所以,你每次交易只需要畀 $ 0.90。要參加 Exness 嘅回贈計劃,你需要透過一間有信譽嘅 IB 註冊一個戶口,而呢間銀行嘅回贈率會較高。

Exness commission 外勤佣金Comparison with Other Exchanges同其他交易所比較

Exness offers some of the lowest commissions in the market, compared to other exchanges like XM, FBS, HotForex, or FXTM. The fees are also adjusted according to market volatility, ensuring clients always receive the best trading conditions. Additionally, Exness has many other advantages, such as no deposit/withdrawal fees or management fees.Exness 提供嘅佣金係市面上最低嘅,相比起其他交易所,例如 XM 、 FBS 、 HotForex 或者 FXTM ,手續費亦都會根據市場波動而調整,確保客戶永遠可以獲得最佳嘅交易條件。另外, Exness 仲有好多其他優點,例如冇存款/提款費或者管理費。

For a comparison of commission fees with other exchanges, see the table below. This comparison table will display the per lot commission and per trade direction for zero and original spread account types, as well as the most popular trading instruments at other exchanges. You will see that Exness's commission fees are always lower than or equal to those of other exchanges.如果想同其他交易所比較佣金,請睇下面嘅表格。呢個比較表會顯示零同原始差價戶口類型嘅每手佣金同每交易方向,同埋其他交易所最受歡迎嘅交易工具。你會見到 Exness 嘅佣金永遠低過或者等於其他交易所。

| Trading Tools 交易工具 | Exness commission 外勤佣金 | XM Commission Fees XM 佣金費用 | FBS Commission Fees FBS 佣金 | HotForex Commission FeesHotForex 佣金費用 | FXTM Commissions and FeesFXTM 佣金同手續費 |

|---|---|---|---|---|---|

| EUR/USD 歐元/美元 | $3.50 | $5 | $6 | $6 | $4 |

| GBP USD 英鎊美元 | 4.5 USD 4.5美元 | $6 | 9 USD 9美元 | 9 USD 9美元 | $6 |

| US Dollar Yen 美元日圓 | $3.50 | $5 | $6 | $6 | $4 |

| Honour 榮幸 | $3.50 | $5 | $6 | $6 | $4 |

| US Dollar to Canadian Dollar美元對加元 | $3.50 | $5 | $7 | $7 | $5 |

Draw conclusions 得出結論

Exness commission 外勤佣金 One of the key factors affecting your trading costs and profits when engaging in online foreign exchange transactions. You need to clearly understand what it is and which types of accounts it applies to, so you can choose your trading strategy accordingly. You also need to know how to minimize commissions by selecting the right account type. Join a rebate program and choose a reasonable trading time.喺進行網上外匯交易嗰陣,影響你嘅交易成本同利潤嘅其中一個關鍵因素你需要清楚明白佢係咩同埋適用於邊啲類型嘅戶口,噉你就可以相應噉揀你嘅交易策略。你亦都需要知道點樣透過選擇合適嘅戶口類型嚟將佣金減至最低。

Hoping this article has provided you with useful information about commission fees. If you would like to learn more about希望呢篇文章可以為你提供有關佣金嘅有用資訊。如果你想知多啲 Ex-Trade 前貿易商 的Information, you can view other articles on our website. Wishing you successful transactions!資訊,你可以喺我哋嘅網站睇其他文章,祝你交易成功!

Read More: 閱讀更多:Secrets to Effective Trading with Exness Social Trading同 Exness 社交交易有效交易嘅秘訣

Frequently Asked Questions常見問題

What is the commission rate?佣金率係幾多?

This is the fee that clients must pay to Exness when trading certain instruments.呢個係客戶喺交易某啲工具嗰陣必須向 Exness 支付嘅費用。

Exness commission 外勤佣金 What's the difference? 有咩分別?

It may vary depending on the account type, trading instrument, and trading time. The minimum commission that clients must pay per trade order is $7.佢可能會因帳戶類型、交易工具同交易時間而有所不同。客戶每個交易訂單必須支付嘅最低佣金係 $ 7。

Which account types are eligible for Exness commissions?邊啲戶口類型有資格獲得 Exness 佣金?

Account types eligible for commissions include Zero Spread and Raw Spread. Commission-free account types include Standard, Standard Cent, and Pro.有資格獲得佣金嘅帳戶類型包括零差價同原始差價。